See This Report on Mileagewise - Reconstructing Mileage Logs

See This Report on Mileagewise - Reconstructing Mileage Logs

Blog Article

The smart Trick of Mileagewise - Reconstructing Mileage Logs That Nobody is Talking About

Table of ContentsFacts About Mileagewise - Reconstructing Mileage Logs UncoveredThe smart Trick of Mileagewise - Reconstructing Mileage Logs That Nobody is DiscussingMileagewise - Reconstructing Mileage Logs Can Be Fun For EveryoneThe Only Guide for Mileagewise - Reconstructing Mileage Logs5 Simple Techniques For Mileagewise - Reconstructing Mileage LogsExcitement About Mileagewise - Reconstructing Mileage LogsSee This Report about Mileagewise - Reconstructing Mileage Logs

Timeero's Quickest Range function recommends the quickest driving course to your workers' destination. This attribute enhances performance and adds to set you back financial savings, making it a crucial property for businesses with a mobile labor force.Such a technique to reporting and conformity streamlines the typically intricate job of handling gas mileage costs. There are several benefits connected with utilizing Timeero to maintain track of mileage.

Mileagewise - Reconstructing Mileage Logs Things To Know Before You Buy

These added verification actions will maintain the Internal revenue service from having a reason to object your mileage records. With exact mileage monitoring innovation, your staff members don't have to make harsh gas mileage quotes or even fret concerning gas mileage cost tracking.

For instance, if an employee drove 20,000 miles and 10,000 miles are business-related, you can write off 50% of all car costs. You will require to proceed tracking mileage for job also if you're utilizing the actual cost approach. Keeping mileage documents is the only means to separate service and personal miles and give the proof to the IRS

The majority of mileage trackers allow you log your trips manually while computing the distance and reimbursement amounts for you. Numerous likewise featured real-time trip monitoring - you need to begin the application at the beginning of your journey and quit it when you reach your final location. These applications log your start and end addresses, and time stamps, along with the complete distance and reimbursement quantity.

Some Known Details About Mileagewise - Reconstructing Mileage Logs

One of the questions that The INTERNAL REVENUE SERVICE states that automobile expenditures can be taken into consideration as an "regular and needed" expense in the training course of working. This consists of costs such as fuel, maintenance, insurance policy, and the vehicle's devaluation. For these costs to be thought about deductible, the car ought to be made use of for company purposes.

Mileagewise - Reconstructing Mileage Logs - Truths

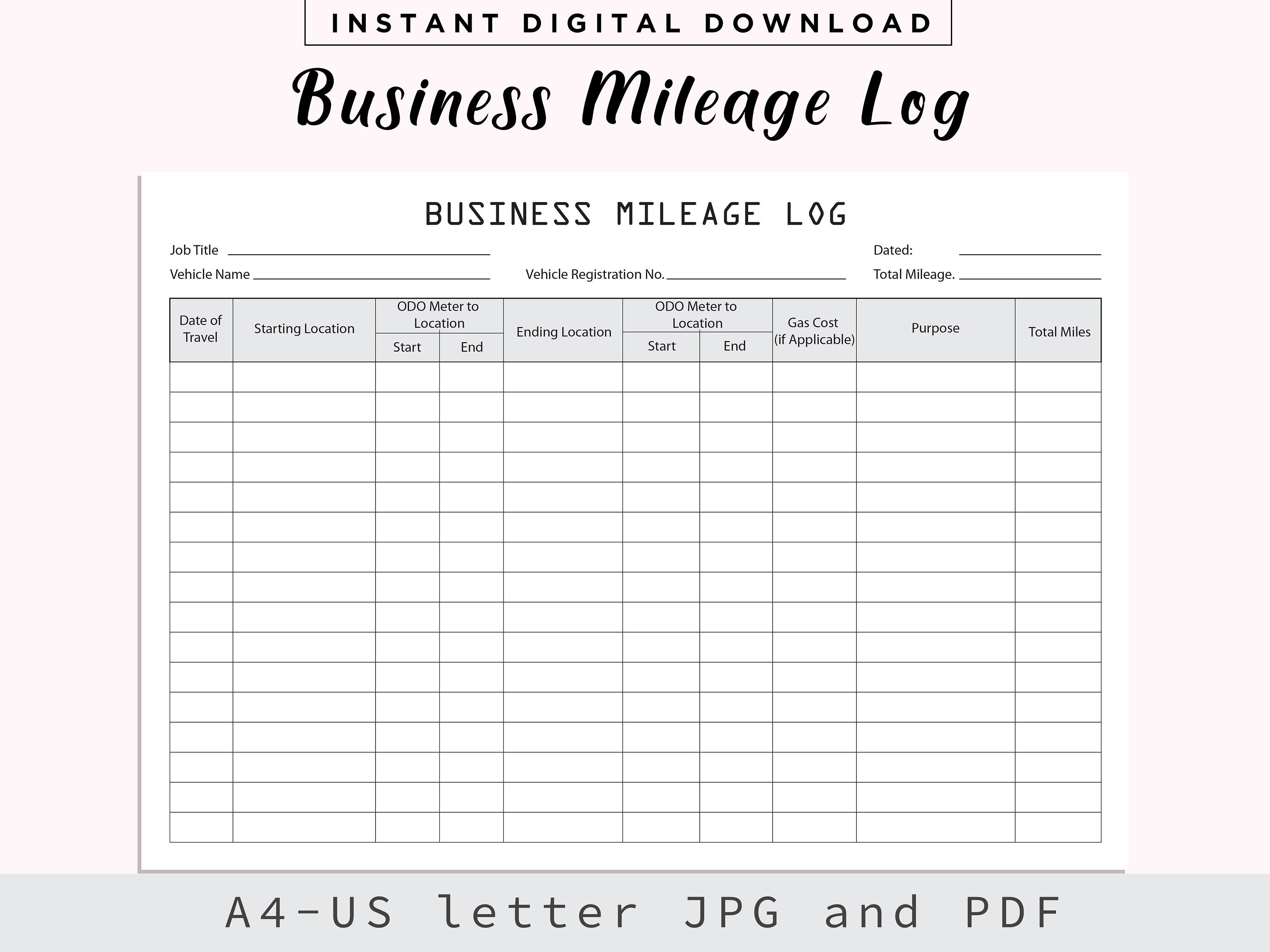

In in between, faithfully track all your company trips keeping in mind down the beginning and finishing analyses. For each trip, record the area and service objective.

This includes the total company gas mileage and overall mileage accumulation for the year (organization + personal), trip's day, destination, and function. It's crucial to tape activities immediately and maintain a synchronous driving log detailing date, miles driven, and service purpose. Below's exactly how you can improve record-keeping for audit objectives: Start with making sure a precise mileage log for all business-related traveling.

Mileagewise - Reconstructing Mileage Logs Can Be Fun For Anyone

The real expenses approach is an alternative to the typical gas mileage rate technique. As opposed to calculating your reduction based on a predetermined rate per mile, the actual costs technique permits you to subtract the actual prices related to using your automobile for organization objectives - simple mileage log. These costs include fuel, upkeep, repair work, insurance coverage, depreciation, and other related costs

Those with substantial vehicle-related expenses or one-of-a-kind problems may benefit from the real expenses approach. Ultimately, your selected approach should straighten with your specific financial objectives and tax obligation circumstance.

The smart Trick of Mileagewise - Reconstructing Mileage Logs That Nobody is Discussing

(https://giphy.com/channel/mi1eagewise)Calculate your complete company miles by using your beginning and end odometer analyses, and your videotaped business miles. Accurately tracking your exact gas mileage for company trips aids in validating your tax obligation reduction, particularly if you decide for the Requirement Gas mileage technique.

Tracking your gas mileage manually can call for diligence, but remember, it might conserve you money on click here to find out more your taxes. Comply with these steps: List the date of each drive. Videotape the overall gas mileage driven. Consider noting your odometer analyses prior to and after each trip. Write the beginning and ending factors for your journey.

Getting The Mileagewise - Reconstructing Mileage Logs To Work

In the 1980s, the airline company industry came to be the initial business customers of general practitioner. By the 2000s, the shipping sector had embraced general practitioners to track plans. And currently almost everybody makes use of GPS to obtain about. That implies almost every person can be tracked as they go concerning their business. And there's the rub.

Report this page